Sooo, it seems, public money is once again being used to bail out big business, while small businesses and green businesses have to use commercial loans.

Research and campaign group Positive Money has welcomed the Treasury Committee’s plans to relaunch its inquiry into the decarbonisation of the UK economy and green finance.

Fran Boait, executive director of Positive Money said: “It is vital that the Treasury and Bank of England are held to account on the unprecedented public support offered to companies over the past few months, in order to ensure that our response to the COVID crisis does not harm our response to the climate crisis. Currently it appears that much of the financial support offered to the biggest companies, such as the billions which have gone to high-carbon corporations through the Bank of England’s bailout scheme, not only fail pledges to ‘build back better’, but also the government’s own climate goals. Without green conditions to financial assistance, public money will be propping up business models which are completely incompatible with efforts to decarbonise by 2050.”

A report from Positive Money published in July revealed that 56% of funds provided by the Bank of England’s Covid Corporate Financing Facility (CCFF) were going to high-carbon sectors, including airlines and oil and gas companies.

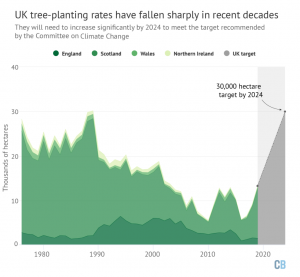

It should perhaps be noted that, already, more than 6.9bn trees would need to be planted to sequester all of the carbon emitted by companies receiving CCFF funds in the 2018/19 reporting year – a feat which would require covering an area three times the size of the UK with trees capable of carbon storage. https://www.carbonbrief.org/in-depth-qa-how-will-tree-planting-help-the-uk-meet-its-climate-goals

The Covid Corporate Financing Facility (CCFF) is a Bank of England and HM Treasury scheme implemented in response to the economic fallout of Covid-19. It is a highly exclusive and privileged facility, designed to provide the UK’s biggest corporations with access to billions of pounds in cheap loans directly from the Bank of England. The terms of these loans are significantly more favourable than those offered to the country’s SMEs, who face far higher interest rates on commercial bank emergency loans. https://www.bankofengland.co.uk/markets/market-notices/2020/joint-hmt-and-boe-ccff-consolidated-market-notice-may-2020

Positive Money’s recent report on the CCFF can be viewed in full here: https://positivemoney.org/publications/ccff/